What Patients at Bodiatrics Really Need to Know

This is usually one of the first questions patients ask — sometimes even before they ask about the surgery itself.

And it makes sense.

Bariatric surgery is a major decision, and no one wants to move forward without understanding the financial side.

At Bodiatrics, this conversation happens every single day. Some patients assume insurance never covers weight loss surgery. Others assume it always does. The reality is somewhere in between.

Let’s break it down in plain terms.

The Short Answer: Sometimes Insurance Covers It. Sometimes It Doesn’t.

Insurance coverage for bariatric surgery depends on a few key factors:

- Your specific insurance plan

- Whether bariatric surgery is a covered benefit

- Medical criteria (not just weight)

- Documentation and approval steps

At Bodiatrics, insurance coverage isn’t guessed — it’s verified upfront, before you’re ever asked to commit to anything.

When Insurance Does Cover Bariatric Surgery

Many commercial insurance plans do cover bariatric surgery, including:

Coverage is usually based on medical necessity, not cosmetic goals.

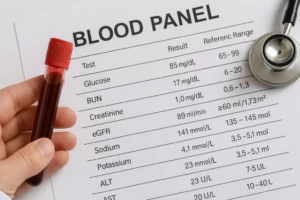

Insurance companies typically look for ideal candidates for bariatric surgery:

- A qualifying BMI (often 35+ with conditions, or 40+ without)

- Obesity-related health issues (diabetes, sleep apnea, hypertension, joint pain)

- A documented history of weight loss attempts

- Pre-operative evaluations (labs, nutrition visits, sometimes psychological screening)

This is where Bodiatrics stands out.

Their team handles insurance verification and pre-authorization directly. Patients aren’t left trying to decode insurance language or chase approvals on their own.

When Surgery Is Not Covered — And Why

Some plans simply exclude bariatric surgery cost, no matter the medical need. This is common with:

- Certain employer-based plans

- Older policies

- Plans that label bariatric surgery as an “exclusion”

- In these cases, it’s not a medical decision — it’s a policy limitation.

At Bodiatrics, this is explained clearly and early. No surprises later. No pressure.

What “Self-Pay” Really Means at Bodiatrics

When insurance doesn’t cover surgery, patients can still move forward through self-pay options.

Self-pay doesn’t mean “figure it out on your own.”

At Bodiatrics, it usually includes:

- Transparent, upfront pricing

- Bundled surgical care (not hidden add-ons)

- Financing options for qualified patients

- A clear breakdown of what’s included

Many patients are surprised to learn that self-pay surgery can sometimes cost less than expected — especially when compared to years of medications, programs, or complications tied to untreated obesity.

Why Bodiatrics Doesn’t Push One Path Over Another

One of the reasons patients trust Bodiatrics is because they don’t force everyone into surgery.

They offer:

- Medical weight loss

- GLP-1 therapy

- Metabolic testing

- DEXA scans

- Nutritional coaching

- Bariatric surgery when appropriate

That means if surgery isn’t covered — or isn’t the right step yet — patients still have medically guided options, not dead ends.

What Happens During Your Financial Review

This part is usually more straightforward than people expect.

At Bodiatrics, patients can expect:

- Insurance benefits checked before moving forward

- Clear explanation of coverage or denial

- Honest discussion of timelines and requirements

- Review of self-pay and financing if needed

- No pressure to “decide on the spot”

The goal is clarity, not confusion.

A Common Misconception Patients Have

A lot of people assume:

“If insurance doesn’t cover it, surgery must not be medically necessary.”

That’s not true.

Coverage decisions are about policy rules, not medical judgment. That’s why Bodiatrics focuses on what’s right for the patient — regardless of how the insurance piece lands.

Frequently Asked Questions

Contact Bodiatrics

If you’re considering weight-loss surgery and want a clear answer about insurance coverage, the best next step is a consultation with experieced bariatric surgeon such as Dr. Will Johnson.

At Bodiatrics, you’ll get:

- Real answers about coverage

- Honest guidance on all options

- A plan that fits your health goals — not just your policy

Phone: (404) 854-4123

Website: https://bodiatrics.com

No assumptions.

No pressure.

Just a clear path forward.

Financing

Financing